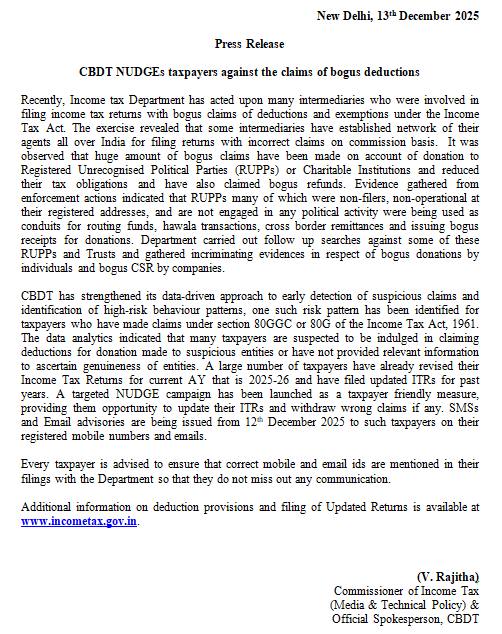

S U P R E M E C O U R T O F I N D I A RECORD OF PROCEEDINGS

Petition for SpecialLeave to Appeal(C) No. 31296/2025

[Arising out of impugned final judgment and order dated 28-08-2025 in MAT No. 1212/2025 passed by the High Court at Calcutta]

ROSHAN SHARMA Petitioner(s)

VERSUS

DEPUTY COMMISSIONER OF REVENUE, STATE TAX &ANR. Respondent(s)

IA No. 276202/2025 - EXEMPTION FROM FILING C/C OF THE IMPUGNED JUDGMENT

Date : 10-11-2025 This matter was called on for hearingtoday.

CORAM :

HON'BLE MR. JUSTICE J.B. PARDIWALA HON'BLE MR. JUSTICE K.V. VISWANATHAN

For Petitioner(s) :Mr. Vinay Shraff,Adv.

Mr. Ravi Bharuka,AOR Mr. Dev Agarwal, Adv.

Mr. Shashank Chamoli,Adv.

For Respondent(s) :

UPON hearing the counsel the Court made the following

O R D E R

- Heard Mr. Vinay Shraff, the learned counsel appearing for the petitioner.

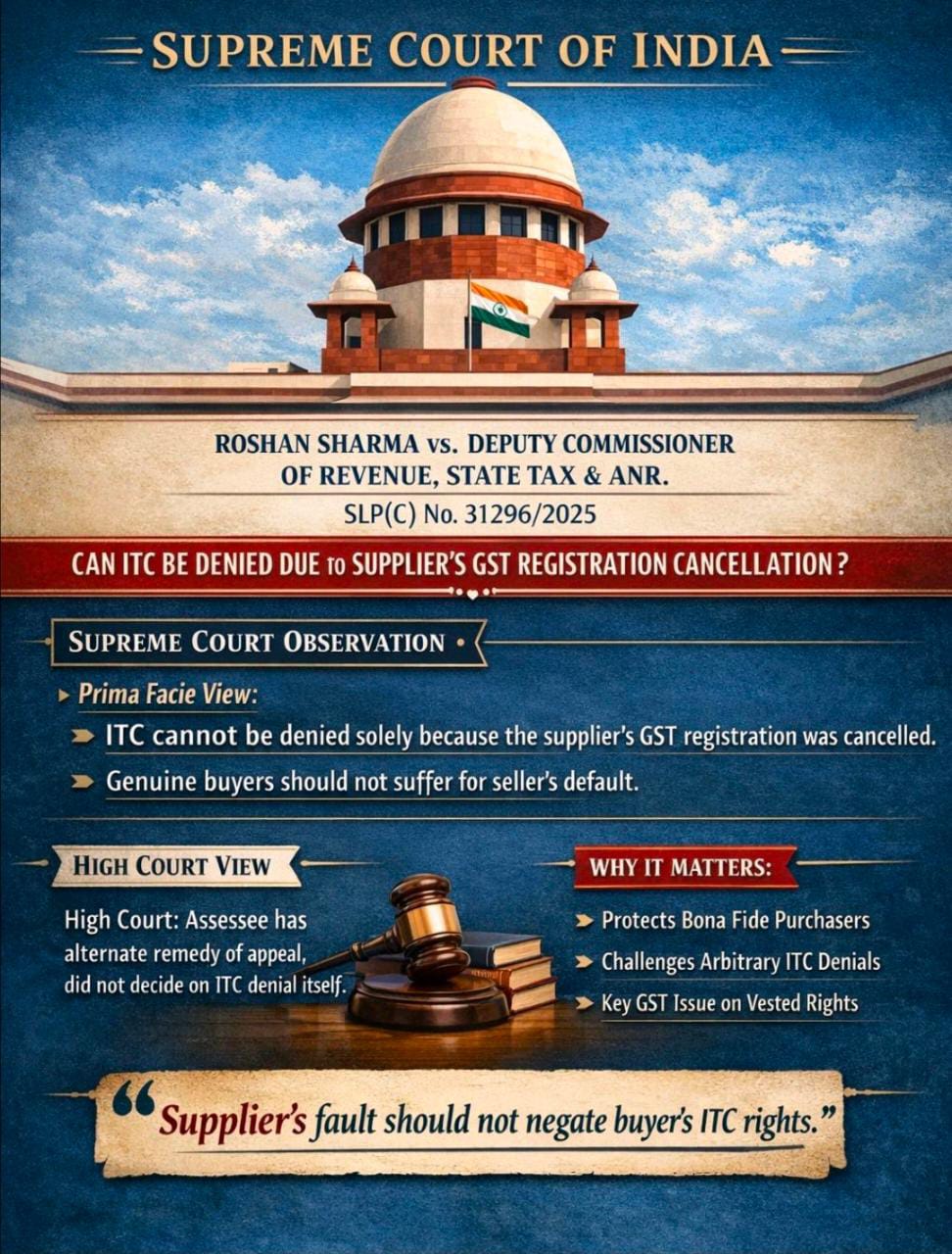

- Prima facie it appears that the High Court declined to grant any relief to the petitioner herein on the ground that the petitioner has an alternative efficacious remedy of going before the Commissioner, GST.

- The principal argument of the learned counsel is that ITC cannot be denied solely on the ground that the GST registration of the seller of goods has been cancelled. In other words, goods were purchased by the petitioner herein from a particular party and the GST registration of that party has stood cancelled. In such circumstances, his submission is that the ITC, insofar as the petitioner is concerned, could not have been denied.

- Issuenotice, returnable on 8.12.2025.

- One copy of the entire paper books shall be served to Ms. Madhumita Bhattacharya, the learned counsel, who ordinarily appears for the State of West Bengal.

(CHANDRESH) (POOJA SHARMA)

ASTT. REGISTRAR-cum-PS COURT MASTER(NSH)

Read More